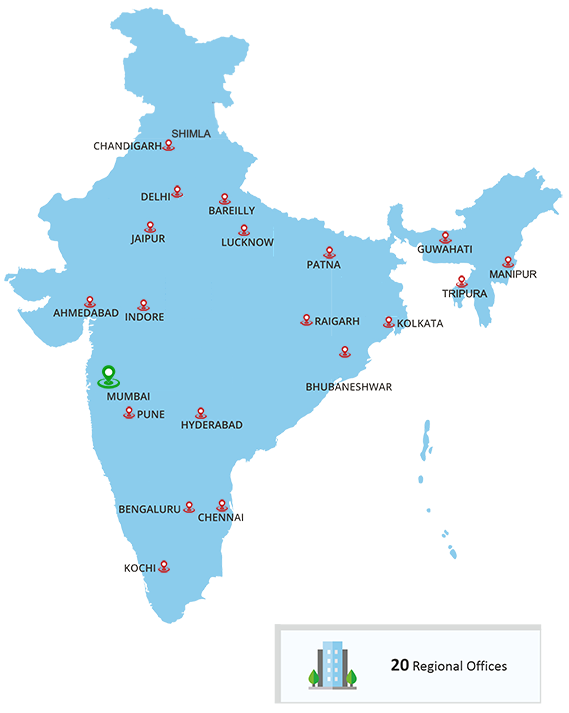

Join our Partner Program

North & East

Harmeet Singh

9891252605

West

Chaitali Vhadge

9619191453

South

Sadique Shaikh

9619190052

If you have any complaints or want to seek specific information about the electronic signatures

that we have issued and where you suspect fraudulent issuance, erroneous issuance,

impersonation or any such other discrepancy kindly write an email to - poonam.more@verasys.in

For timely and proper disposal of your complaint make sure you mention all the necessary details and relevant

photos/screenshots, if any.

Alternatively you can also write to :

Name of grievance officer : Poonam More

Contact No : 022-43156000 / 9136040453

Address : Office No. 21,

2nd Floor, Bhavna Building,

Opp. Siddhivinayak Mandir,

V.S.Marg, Prabhadevi, Mumbai - 400025

In case of any complaints which are not attended within 3 working days from receipt thereof, you can contact us

on 9136040453 for status of your complaint. Complaints sent via any mode other than

above, may not get attended by us.